|

|

|

| Critical

Illness Insurance |

|

|

|

| Critical

Illness |

|

|

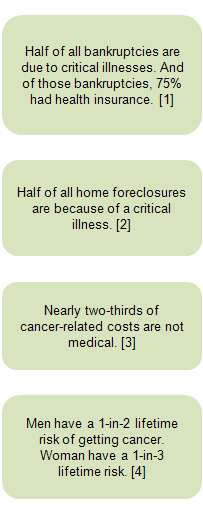

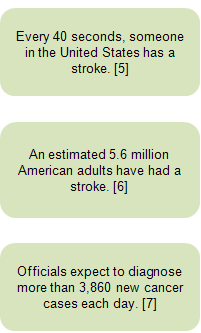

Critical Illness insurance can help relieve the financial impact of

a sudden, life-threatening event by helping to pay the direct and

indirect costs of the illness. The policy provides a lump sum cash

benefit upon the first diagnosis of a covered critical illness after

the policy effective date. Covered critical illnesses are limited

to the specific definitions found in the policy. Covered illnesses

include: |

|

| Heart

Attack |

Permanent

paralysis |

| Stroke |

Major

organ transplant surgery |

| Cancer |

End-stage

renal (kidney) failure |

| Burns |

Coronary

bypass surgery |

|

|

- Critical

Illness insurance does not require a specific expense for payout.

It is intended to help cover some of the expenses not covered

by medical insurance, such as experimental treatments, out-of-pocket

deductibles and copays, child care, travel expenses, and more.

- Coverage

includes insurance benefits, education to promote wellness and

early detection along with LIVESTRONG®

Survivor Care resources to help those who are diagnosed stay focused

on recovery.

-

If you are diagnosed with a covered illness, this plan will pay

you an amount that depends on the illness.

-

You can purchase coverage for yourself, for yourself and your

children or for your entire family.

-

Limited or no medical underwriting will be required if the amount

of coverage being applied for does not exceed $20,000.

- For

a complete description of this benefit please follow the link

below to the product brochure.

|

|

|

|

|

|

|

|

FORMS |

|

Critical

Assistance plus Consumer Information Sheet Critical

Assistance plus Consumer Information Sheet |

Medicare

Disclosure (Required if age 65 or older or if qualified for medicare) Medicare

Disclosure (Required if age 65 or older or if qualified for medicare) |

HIPAA

Notice (Required with each application) HIPAA

Notice (Required with each application) |

TWM

Privacy Notice TWM

Privacy Notice |

Critical

Assistance plus Employee Application-MD Critical

Assistance plus Employee Application-MD |

Critical

Assistance plus Employee Application-NV Critical

Assistance plus Employee Application-NV |

Critical

Assistance Rates Critical

Assistance Rates |

| |

| |

|

|

|

|

|

Top Top |

|

|